Conscious Spending

Create a Conscious Spending Plan.

By planning where you want your money to go ahead of time, you could make sure you were saving and investing enough money each month, and then use the rest of your money guilt-free for whatever you want.

The Difference Between Cheap and Frugal

Spend on what you love, cut ruthlessly elsewhere

- It’s okay to spend on things like travel, dining out, etc.

- What matters is that it’s intentional and within your plan, not mindless or to impress others.

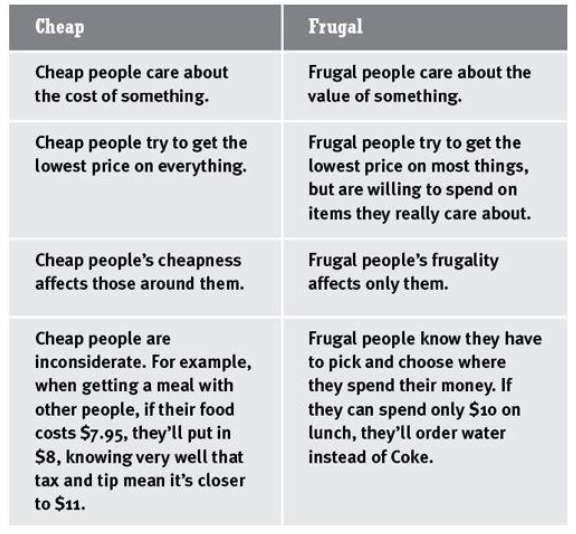

Frugality ≠ cheapness

- Choosing not to spend $2.50 on soda so you can watch a movie isn’t “cheap”—it’s smart, value-based spending.

- Most people confuse frugality with being stingy and give up altogether.

Spending is socially contagious

- “Sex and the City effect”: People tend to mimic their friends’ spending habits, even if their incomes differ.

- Research shows friends influence each other’s behavior, like gaining weight or overspending.

Cheap people vs. Frugal people

Spend on What You Love

Frugality isn’t about cutting your spending on everything!

Frugality is about choosing the things you love enough to spend extravagantly on—and then cutting costs mercilessly on the things you don’t love. In other words, it’s about making your own decisions about what’s important enough to spend a lot on, and what’s not, rather than blindly spending on *everything.*

Use Psychology Against Yourself to Save

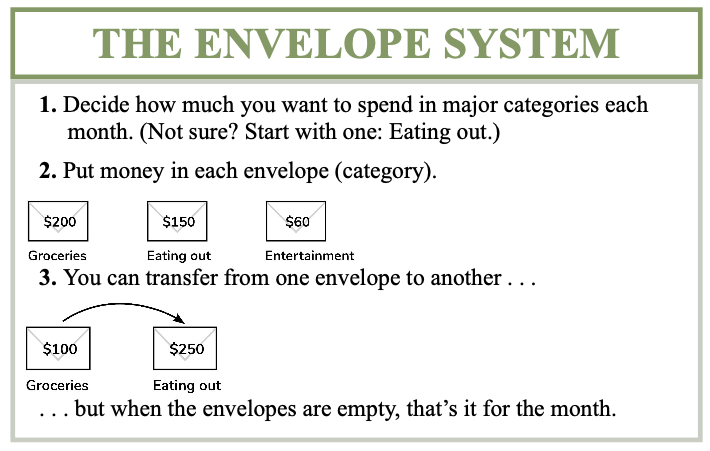

THE À LA CARTE METHOD

How to implement? (take subscription as example)

Idea: Instead of subscribing and paying regularly for services, you pay only when you actually use them.

- Calculate how much you’ve spent over the last month on any discretionary subscriptions you have (for example, music subscriptions, Netflix, and the gym).

- Cancel those subscriptions and begin buying these things à la carte. (But don’t let losing the gym membership be your excuse to become a fat ass.)

- In exactly one month, check and calculate how much you spent on these items over the last month. That’s the descriptive part.

- Now, get prescriptive. If you spent 90. Then $75. Not too low—you want your spending to be sustainable, and you don’t want to totally lose touch with what’s going on in the world. But you can control exactly how many movies you rent or how many magazines you buy, because each one comes out of your pocket.

Why it works

- You’re probably overpaying already.

- You’re forced to be conscious about your spending.

- You value what you pay for.

Downside: requires you to de-automate your life.

Conscious Spending Plan

Conscious spending means you decide exactly where you’re going to spend your money—for going out, for saving, for investing, for rent—and you free yourself from feeling guilty about your spending. Along with making you feel comfortable with your spending, a plan keeps you moving toward your goals instead of just treading water.

A Conscious Spending Plan involves four major buckets where your money will go:

| Category | Percentage of take-home pay |

|---|---|

| Fixed costs (Rent, utilities, debt, etc) | 50-60% |

| Investments | 10% |

| Savings (Vacations, gifts, house down payment, unexpected expenses) | 5 - 10% |

| Guilt-free spending money (Dining out, drinking, movies, clothes, shoes) | 20 - 35% |

Fixed Costs

The amounts you must pay, like your rent/mortgage, utilities, cell phone, and student loans.

Good rule of thumb: 50– 60% of your take-home pay

Step by step

Fill out the chart with common basic expense.

- Do Not include “eating out” or “entertainment,” as those come out of the guilt-free spending category.

- You’ll need to look at your past spending to fill in all the amounts, and to make sure you’ve covered every category. Limit this to the past month to keep things simple. The easiest way to get an idea of what you’ve spent where is to look at your credit card and banking statements.

Category Monthly Cost Rent/mortgage Utilities Cell phone Medical insurance, bills Car payment Public transportation Loans Groceries Clothes Internet/cable … Once you’ve gotten all your expenses filled in, add 15% for expenditures you haven’t counted yet. (A flat 15% will cover you for things you haven’t figured in, and you can get more accurate as time goes on.)

Once you’ve got a fairly accurate number here, subtract it from your take-home pay. Now you’ll know how much you’ll have left over to spend in other categories like investing, saving, and guilt-free spending.

Investments

- This bucket includes the amount you’ll send to your 401(k) and Roth IRA each month.

- A good rule of thumb is to invest 10 percent of your take-home pay (after taxes, or the amount on your monthly paycheck) for the long term.

Savings

- This bucket includes

- short-term savings goals (like Christmas gifts and vacation)

- midterm savings goals (a wedding in a few years)

- larger, longer- term goals (like a down payment on a house).

- This bucket includes

Guilt-free Spending Money

- This bucket contains the fun money —the stuff you can use for anything you want, guilt-free, like going out to restaurants and bars, taxis, movies, and vacations.

- Good rule of thumb: 20 to 35 percent of your take-home income

Optimizing Your Conscious Spending Plan

- Go for BIG wins

- Focus on big wins, not tiny cuts – Use the 80/20 rule: 80% of overspending often comes from 20% of expenses.

- Big changes in a few high-impact areas create significant results. Small cuts like skipping soda or generic cookies have minimal long-term effect - They serve more to make people feel good about themselves, which lasts only a few weeks once they realize they still don’t have any more money.

- Identify your big wins, expenses you admit you overspend on and feel guilty about (often eating out and drinking), and focus on just 1-2 each month.

- Set realistic goals

- Sustainability is the core to personal finance.

- When a person goes from one extreme to another, the behavioral change rarely lasts.

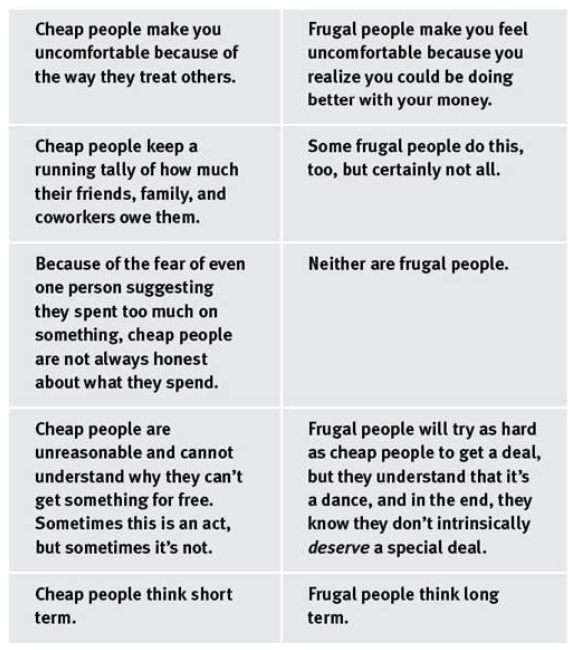

Use the Envelope System to Target Your Big Wins

Envelope system

- You allocate money for certain categories like eating out, shopping, rent, and so on.

- Once you spend the money for that month, that’s it: You can’t spend more.

- If it’s really an emergency, you can dip into other envelopes —like your “eating out” envelope—but you’ll have to cut back until you replenish that envelope. (You can transfer from one envelope to another . . . but that money is coming out of another category, so your total spending doesn’t actually increase.)

Negotiate a Raise

Remember that getting a raise is not about you. It’s about you demonstrating your value to your employer.

- You can’t tell them you need more money because your expenses are higher. Nobody cares.

- You can, however, show how your work has been contributing to the company’s success and ask to be compensated fairly.

What you need to do:

- Three to six months before you ask for a raise, sit down with your boss and ask what it would take to be a top performer at your company. Get crystal clear about what you’d need to deliver. And ask how being a top performer would affect your compensation.

- Three to six months before your review: Become a top performer by collaboratively setting expectations with your boss, then exceeding those expectations in every way possible.

- One to two months before your review: Prepare a “briefcase” of evidence to support the exact reasons why you should be given a raise.

- One to two weeks before your review: Extensively practice the conversation you’ll have with your boss, experimenting with the right tactics and scripts.

Maintaining Your Spending Plan

Once you’ve done what you can to design and implement a Conscious Spending Plan that you’re comfortable with, give yourself some time to settle into a rhythm with it.

As you go along from month to month with this new system, you’ll discover some surprises you hadn’t anticipated.

How to handle unexpected and irregular expenses

Known irregular events

Under savings goals, allocate money toward goals where you have a general idea of how much it will cost. It doesn’t have to be exact, but try to get a ballpark figure and then save every month toward that goal.

Unknown irregular events

- Starting by allocating $50/month for unexpected expenses

- If luckily there is money left over in the account by the end of the year: save half of it—and spend half on something fun.

With each month that goes by, you’ll get a more accurate picture of your spending. After about a year or two, you’ll have a very accurate understanding of how to project. The beginning is hard, but it only gets easier.

The “problem” of extra income

- Unexpected one-time income

- Use 50 percent of it for fun —usually buying something I’ve been eyeing for a long time

- The other half goes to the investing account

- Raises

- Key thing to remember: It’s okay to increase your standard of living a little—but bank the rest. It’s too easy to think a single raise lets you move up to a totally different financial level in a single step!

- Treat yourself to something nice that you’ve been wanting for a long time, and make it something you’ll remember. After that, save and invest as much of it as possible!

The Beauty of a Conscious Spending Plan

The best part about setting up a strategic Conscious Spending Plan

- It guides your decisions, letting you say no much more easily—“Sorry, it’s not in my plan this month”.

- It frees you up to enjoy what you do spend on.