Investing is not Just for Rich People

Choose your own investments, pay less in fees, and get superior performance

Determine your investing style by asking yourself some key questions:

- Do you need your money next year, or can you let it grow for a while?

- Are you saving up for a house?

- Can you withstand big day-to-day changes in the stock market, or do they make you queasy?

Goal: pick the simplest investment to get started— and to make your portfolio easy to maintain.

A Better Way to Invest: Automatic Investing

Automatic investing involves

- spending most of your time choosing how your money will be distributed in your portfolio,

- then picking the investments (this actually takes the least amount of time), and

- finally automating your regular investments so you can sit and watch TV while growing your money.

Automatic investing works for two reasons

Lower expenses

With automatic investing, you invest in low-cost funds—which replace worthless, expensive portfolio managers—and you save tens of thousands of dollars in trading fees, taxes incurred by frenetic trading, and overall investment expenses, thereby outperforming most investors.

It’s automatic

- Frees you from having to pay attention to the latest “hot stock” or micro-change in the market

- You pick a simple investment plan that doesn’t involve any sexy stocks or guessing whether the market is going up or down, and then you set up automatic contributions to your investment accounts. → This means you can focus on living your life instead of worrying about your money.

The test of a real automatic investor is not when things are going up, but when they are going down. It takes strength to know that you’re basically getting shares on sale — and, if you’re investing for the long term, the best time to make money is when everyone else is getting out of the market.

With headlines like “Market Correction” and “Stock Drops 10% Overnight.”, it’s easy to practice the “DNA” style of investing — the Do Nothing Approach.

“Be fearful when others are greedy and greedy when others are fearful.” — Warren Buffett

The Magic of Financial Independence

Financial Independence (FI): Money makes money, and at a certain point, your money is generating so much new money that all of your expenses are covered

(your investments were generating so much money that your money was actually producing more money than your salary)

Retire Early (RE) (often in your thirties or forties)

FIRE: Financial Independence + Retiring Early

- “LeanFire”: people who’ve decided they can live on a “lean” amount of money— often 50,000 a year in perpetuity. They reject materialism and embrace simplicity, often in an extreme way.

- “FatFire”: people who want to live an extravagant life at the highest levels of spending

How to reach FIRE?

- Cut your monthly expenses

- Raise your income

- Combination of both - Earn more, spend less!

When chasing FIRE: Remember that life is lived outside the spreadsheet. Be as aggressive as you want with your goals—dream bigger than you ever thought!—but remember that money is just a small part of a Rich Life.

Investing Is Not About Picking Stocks

You can NOT reliably pick stocks that will outperform the market over the long term. It’s way too easy to make mistakes, such as being overconfident about choices or panicking when your investments drop even a little.

The major predictor of your portfolio’s volatility doesn’t stem from the individual stocks you pick, as most people think, but instead from your mix of stocks and bonds (i.e., your assert allocation).

Asset allocation is your plan for investing, the way you distribute the investments in your portfolio between stocks, bonds, and cash.

- In other words, by diversifying your investments across different asset classes (like stocks and bonds or, better yet, stock funds and bond funds), you can control the risk in your portfolio—and therefore control how much money, on average, you’ll lose due to volatility.

- Asset allocation is the most significant part of your portfolio that you can control.

- Your investment plan is more important than your actual investments!

The Building Blocks of Investing

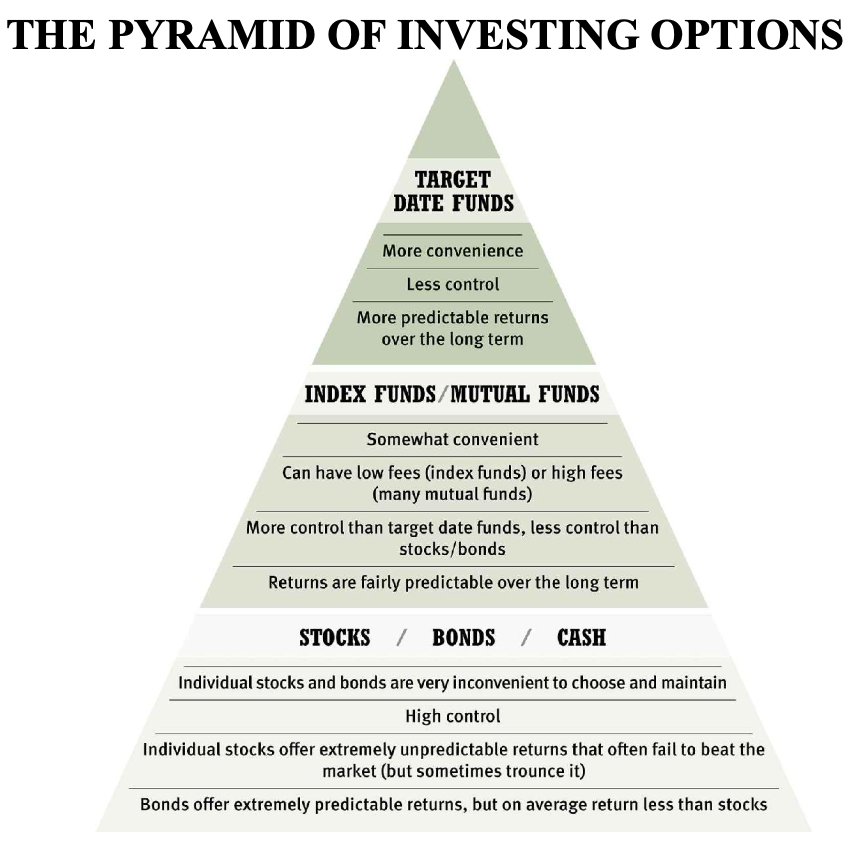

First layer: Stocks / Bonds / Cash

Stocks

- When you buy stock, you buy shares of a company.

- When people talk about “the market,” they’re usually referring to an index of stocks like the Dow Jones (thirty large-cap stocks) or the S&P 500 (500 companies with large market capitalization).

- On average the stock market returns about 8 percent per year.

- In fact, you can do significantly better than the market if you pick a winning stock— or significantly worse if you pick a loser.

- Although stocks as a whole provide generally excellent returns over time, individual stocks are less clear.

- The tricky thing about stocks is you never know what will happen. → It is extremely difficult to choose winning stocks on your own, even professionals.

Bonds

- Advantages

- You can choose the term, or length of time, you want the loan to last, and you know exactly how much you’ll get when they “mature” or pay out.

- Bonds, especially government bonds, are generally stable and let you decrease the risk in your portfolio. The only way you’d lose money on a government bond is if the government defaulted on its loans—and it doesn’t do that.

- Disadvantages

- As bonds are such a safe, low-risk investment, the return— even on a highly rated bond—is much lower than it would be on an excellent stock.

- Investing in bonds also renders your money illiquid, meaning it’s locked away and inaccessible for a set period of time.

- In general, rich people and old people like bonds.

Cash

- Money that’s sitting on the sidelines, uninvested and earning only a little money in interest from money market accounts, which are basically high-interest savings accounts.

- You want to have totally liquid cash on hand for emergencies, and as a hedge if the market tanks.

- Price for this security: Cash is the safest part of your portfolio, but it offers the lowest reward. In fact, you actually lose money by holding cash once you factor inflation in.

- As long as you’re contributing toward your savings goals and have enough to cover emergencies and ideally more, you’re fine.

Asset Allocation: The critical factor that most investors miss

It is important to diversify within stocks, but it’s even more important to allocate across the different asset classes—like stocks and bonds.

- Diversification is D for going deep into a category (for example, buying different types of stocks: large-cap, small-cap, international, and so on)

- Asset allocation is A for going across all categories (for example, stocks and bonds).

Why Asset Allocation Matters

- Determines the majority of your portfolio’s risk and return.

- More important than picking individual stocks.

- Could mean a difference of hundreds of thousands or millions of dollars over time.

- Stocks vs. Bonds

- Stocks = higher long-term returns, but much higher volatility. (Higher risk generally equals higher potential for reward.)

- Bonds = safer, often rise when stocks fall, reduce overall risk with only slightly lower returns.

- Although it may seem counterintuitive, your portfolio will actually have better overall performance if you add bonds to the mix.

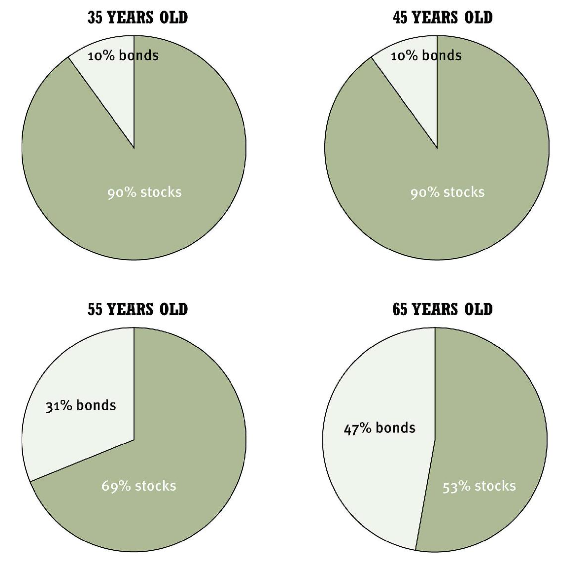

- Age and Risk Tolerance

- 20s: Mostly stocks (long time horizon, can handle risk).

- 30s–50s: Start adding bonds to balance risk.

- 60+: Significant bond allocation to protect capital.

The Importance of Being Diversified

Diversification is about safety in the long term.

Typical asset allocations by age

- If we’re in our twenties and thirties, we can afford to be aggressive about investing in stocks and stock funds—even if they drop temporarily—because time is on our side.

- If you’re nervous about investing and just starting out, your biggest danger isn’t having a portfolio that’s too risky. It’s being lazy and overwhelmed and not doing any investing at all.

Second layer: Mutual funds / Index funds

Mutual Funds

Mutual Funds Overview

- Invented in 1924 to simplify investing for average investors.

- Definition: Baskets of different investments (usually stocks).

- Purpose: Avoid picking individual stocks; provide instant diversification.

Types of Mutual Funds

- Large-cap, mid-cap, small-cap stock funds.

- Sector-focused funds (e.g., biotechnology, communication).

- Region-focused funds (e.g., European or Asian stocks).

Advantages

- Hands-off approach: expert manager handles investments.

- Diversified: reduces risk if one company performs poorly.

- Better than doing nothing—encourages investing for average Americans.

Disadvantages

- High fees: expense ratios, front-end/back-end loads can cost tens of thousands over a lifetime.

- Overlap risk: multiple funds may hold the same stocks, reducing true diversification.

- Performance: 75% of active managers do not beat the market.

- Cost vs. value: paying for expert management often adds little to returns.

Mutual funds are convenient and popular, but actively managed funds are expensive and often underperform.

→ Better alternatives today: low-cost, passive index funds.

Index Funds

Index fund buys stocks and match the market.

Traditional mutual fund, which employs an expensive staff of “experts” who try to predict which stocks will perform well, trade frequently, incur taxes in the process, and charge you fees.

Index fund characteristics:

- No experts needed

- No attempt to beat the market. Goal: match a market index.

- Low cost and tax-efficient

- Minimal maintenance required

→ Index funds discard active management, offering a simple, efficient, long-term investment method.

Market volatility still exists: investing fully in stocks in your 20s and 30s will see ups and downs, but the stock market rises in the long term.

Advantages: Extremely low cost, easy to maintain, and tax efficient.

Disadvantages

- When you’re investing in index funds, you typically have to invest in multiple funds to create a comprehensive asset allocation.

- If you do purchase multiple index funds, you’ll have to rebalance (or adjust your investments to maintain your target asset allocation) regularly, usually every twelve to eighteen months

- Each fund typically requires a minimum investment, although this is often waived with automatic monthly investments.

index funds are clearly far superior to buying either individual stocks and bonds or mutual funds. 👍

Target Date Funds

Target date funds are the easiest investment choice you’ll ever need to make - not exactly perfect, but easy enough for anyone to get started—and they work just fine。

- Target date funds are simple funds that automatically diversify your investments for you based on when you plan to retire.

- Instead of you having to rebalance stocks and bonds, target date funds do it for you.

- Target date funds are actually “funds of funds,” or collections made up of other funds, which offer automatic diversification. Your target date fund will own many funds, all of which own stocks and bonds. → This actually makes things simple for you, because you’ll have to own only one fund, and all the rest will be taken care of for you.

- Target date funds automatically pick a blend of investments for you based on your approximate age. They start you off with aggressive investments in your twenties and then shift investments to become more conservative as you get older.

- Target date funds aren’t perfect for everyone, because they work on one variable alone: when you plan to retire.

- As a general rule, target date funds are low cost and tax efficient.

You Want to Do It on Your Own

Remember:

- Most people who try to manage their own portfolios fail at even matching the market. They fail because they sell at the first sign of trouble, or because they buy and sell too often, thereby diminishing their returns with taxes and trading fees. The result is tens of thousands of dollars lost over a lifetime.

- If you buy individual index funds, you’ll have to rebalance every year to make sure your asset allocation is still what you want it to be

If you want more control over your investments and you just know you’re disciplined enough to withstand market dips and to take the time to rebalance your asset allocation at least once a year → choosing your own portfolio of index funds is the right choice for you.

The key to constructing a portfolio is NOT picking killer stocks! It’s figuring out a balanced asset allocation that will let you ride out storms and slowly grow, over time, to gargantuan proportions.

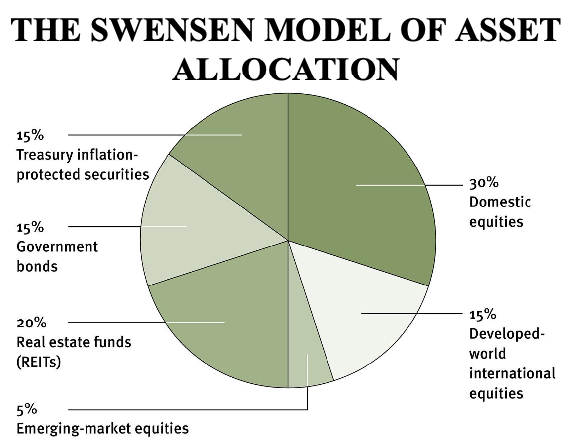

David Swensen suggests allocating your money

- 30 percent—Domestic equities: US stock funds, including small-, mid-, and large-cap stocks

- 15 percent—Developed-world international equities: funds from developed foreign countries, including the United Kingdom, Germany, and France

- 5 percent—Emerging-market equities: funds from developing foreign countries, such as China, India, and Brazil. These are riskier than developed-world equities, so don’t go off buying these to fill 95 percent of your portfolio.

- 20 percent—Real estate investment trusts: also known as REITs. REITs invest in mortgages and residential and commercial real estate, both domestically and internationally.

- 15 percent—Government bonds: fixed-interest US securities, which provide predictable income and balance risk in your portfolio. As an asset class, bonds generally return less than stocks.

- 15 percent—Treasury inflation-protected securities: also known as TIPS, these treasury notes protect against inflation. Eventually you’ll want to own these, but they’d be the last ones I’d get after investing in all the better-returning options first.

Choosing your own index funds means you’ll need to dig around and identify the best index funds for you.

- The first thing you want to do when picking index funds is to minimize fees. - Look for the management fees (“expense ratios”) to be low, around 0.2 percent

- Make sure the fund fits into your asset allocation.

- Use David Swensen’s model as a baseline and tweak as necessary if you want to exclude certain funds or prioritize which are important to you.

- If you have limited money and you’re in your twenties, you’d probably want to buy the stock funds first so you could get their compounding power, whereas you could wait until you’re older and have more money to buy the bond funds to mitigate your risk.

- When you look for various funds, make sure you’re being strategic about your domestic equities, international equities, bonds, and all the rest. You can NOT just pick random funds and expect to have a balanced asset allocation.

- You should absolutely look at how well the fund has returned over the last ten or fifteen years. But remember that, as they say, past performance is no guarantee of future results!

Pick the number of funds that will let you get started, realizing that you can adjust it later on to get a balanced asset allocation. Spend time identifying the funds that will help you build a full, balanced asset allocation over time.

💡 Take Away

- Low cost + Asset allocation alignment + Long-term diversification = The core principles of index fund investing.

- You can gradually increase the number of funds and ultimately build a balanced portfolio.

Dollar-cost Averaging: Investing Slowly over Time

“Dollar-cost averaging” is a phrase that refers to investing regular amounts over time, rather than investing all your money in a fund at once.

- By investing at regular intervals over time, you hedge against any drops in the price

- You don’t try to time the market. You use time to your advantage. → This is the essence of automatic investing, which lets you consistently invest in a fund so you don’t have to guess when the market is up or down.

- To set up automatic investing, configure your accounts to automatically pull a set amount of money from your checking account each month.

If you have a lump sum of money, most of the time you’ll get better returns by investing it all at once.

Vanguard research found that lump-sum investing actually beats dollar-cost averaging two-thirds of the time.

But investing isn’t just about math, but about the very real effects of your emotions on your investing behavior.

Buying into Individual Index Funds

Once you’ve got a list of index funds you want to own in your portfolio —usually three to seven funds—start buying them one by one. If you can afford to buy into all of the funds at once, go for it 💪.

Once you own all the funds you need, you can split the money across funds according to your asset allocation—but do NOT just split it evenly. Remember, your asset allocation determines how much money you invest in different areas.

If you opt for investing in your own index funds, you’ll have to rebalance about once a year, which will keep your funds in line with your target asset allocation.

Other Kinds of Investments

You can also invest in precious metals, real estate, private startups, cryptocurrency, or even art; just don’t expect very good returns.

Real Estate

The returns of real estate are generally poor, especially when you factor in costs like maintenance and property taxes —which renters don’t pay for, but homeowners do.

If you do buy real estate, regardless of whether it’s to live in or to invest in, be sure to keep funding the rest of your investment areas—whether that’s a target date fund or your own portfolio of index funds.

Art

“The returns of fine art have been significantly overestimated, and the risk, underestimated.”

— research done by Stanford analysts in 2013

The real annual return of art over the past four decades is closer to 6.5 percent versus the 10 percent that is claimed.

- The main reason for the overestimation is due to selection bias

- By choosing particular art pieces as investments, you’re doing essentially the same thing as trying to predict winning stocks, which is very difficult.

High-Risk, High-Potential-for-Reward Investments

Use a small part of your portfolio for “high risk” investing —but treat it as fun money, not as money you need.