Create Risk Profile

💡 Take Away

- Your risk tolerance depends on factors like age, income, personality, responsibilities, and individual circumstances.

- Allocate your investments: Decide how much to invest in risk-free assets vs. riskier assets.

- Riskier investments (e.g., individual stocks, ETFs, REITs, commodities) generate returns.

- Low-risk investments cushion portfolio fluctuations. Options include: Savings accounts (Tagesgeld), Fixed-term deposits (Festgeld), Cash, and Government bonds from AAA-rated countries.

- Risk tolerance can change over time as your life circumstances evolve.

No Investment Without Risk!

Investing in the stock market always involves risks. You can counteract and minimize these risks with a solid strategy, but you can NOT eliminate them entirely. It’s important to

- be aware of the risks and

- tailor your investments to your personal risk tolerance

How Risk-Tolerant Are You?

Your investment strategy should fit your personality, allowing you to sleep soundly during market fluctuations. Otherwise, you risk selling at the wrong time and losing money.

This defines your personal risk tolerance which is reflected in how much volatility and loss you can endure before changing your behavior (more see Rick Ferri’s book “All About Asset Allocation”). You often only discover how market fluctuations affect you once you start investing. Many people overestimate their risk tolerance and only realize it after experiencing a loss following years of gains.

Diversify Your Wealth

You should never rely on just one type of investment. Instead, divide your wealth across different asset classes, each carrying its own risks. By allocating your wealth, you can create a portfolio that matches your risk profile.

Asset Allocation in 2 Steps

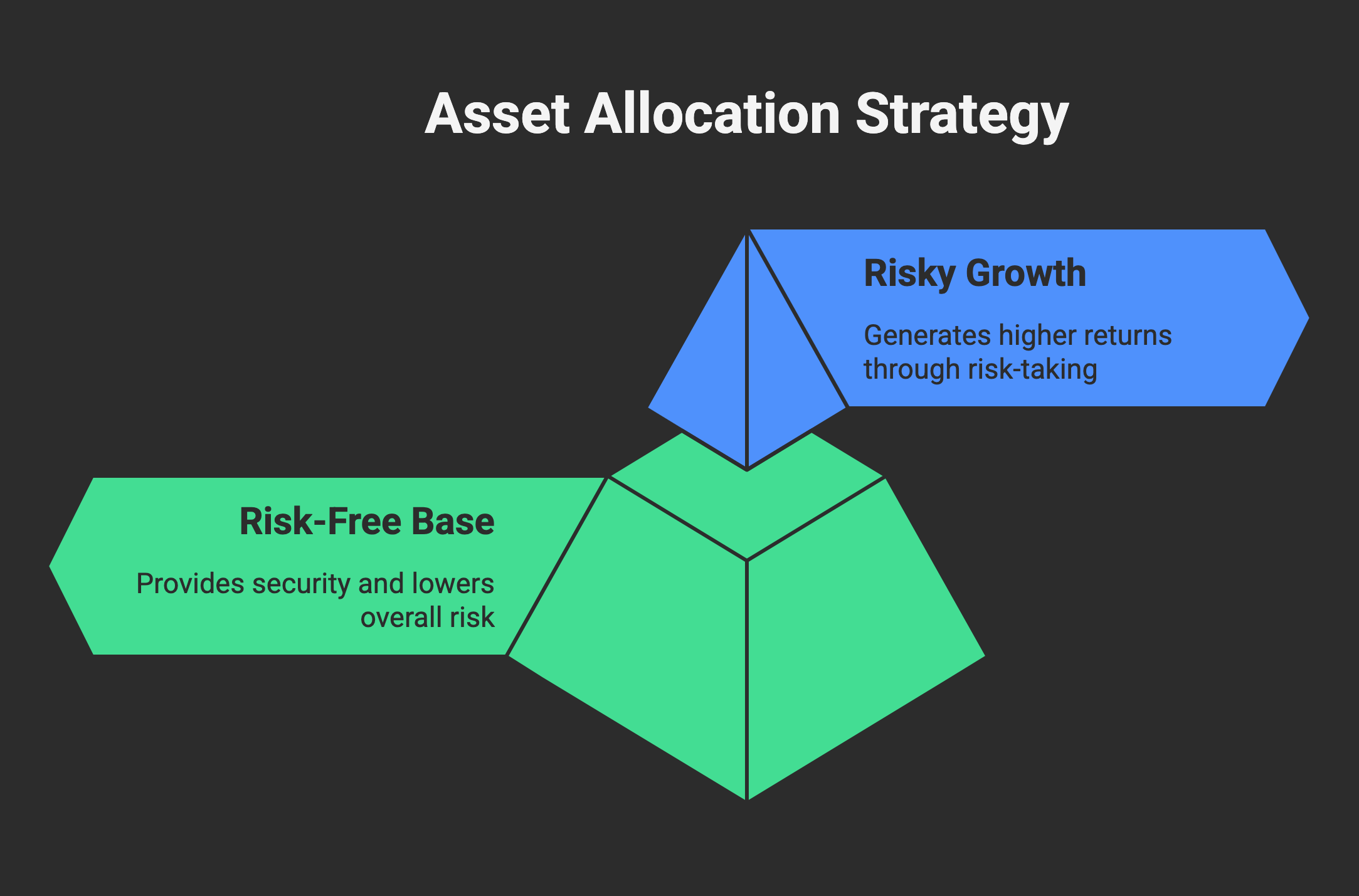

- Decide how much of your money goes into riskier investments and how much into risk-free assets.

- The risk-free portion lowers your overall risk and provides the security you need.

- The riskier portion generates returns.

- Fill these categories with specific investment products.

Build an Emergency Fund

Regardless of your investments, you should build an emergency fund. Depending on your life situation, keep around 3 months’ net salary in a checking or savings account.

Risky investments

Risky investments are those without guarantees but with significant fluctuations.

- The higher the volatility, the greater the risk.

- The higher the chance of the investment failing, the more potential reward you can earn.

Examples of Risky Investments

- Individual Stocks

- Stock ETFs and Index Funds

- REITs (Real Estate Investment Trusts)

- Corporate Bonds

- Low-Rated Government Bonds

- Cryptocurrencies

- P2P Lending

These investment types vary in risk. For example, an individual stock is riskier than a stock index fund, and stocks themselves differ in risk levels. Research the risks of each investment type and weigh them against the expected returns.

Government Bonds

With a government bond, you lend money to a country (e.g., Germany) for a fixed period. In return, you receive a coupon, a fixed interest rate. Countries are rated based on their creditworthiness. The highest rating is AAA, and the lowest is D (indicating the country is in default).

Low-risk investments

The low-risk portion of your portfolio reduces overall risk and cushions fluctuations. Remeber: It is not meant to generate high returns! Truly risk-free investments do not exist—even cash in your wallet carries some risk. However, certain investment types have proven to be low-risk over time.

Examples of Low-Risk Investments

- Fixed-Term Deposits (Festgeld) in euros, up to €100,000 in countries with the best credit ratings.

- Savings Accounts (Tagesgeld) in euros, up to €100,000 in countries with the best credit ratings.

- Government Bonds from countries with AAA ratings (e.g., Germany, Luxembourg, Netherlands).

- Cash

Avoid risky foreign banks for savings or fixed-term deposits. Earning 1% interest from unstable banks is not worth the risk.

While the interest rates on bonds from riskier countries like Greece or Italy may be high, they are not suitable for the low-risk portion of your portfolio.

Finding the right balance

The risky portion of your portfolio generates returns, while the low-risk portion provides stability by reducing overall fluctuations. These two parts complement each other.

Example

If you invest half your wealth in risky assets and the stock market drops by 30%, your portfolio’s value will only decrease by 15% because the other half is in stable investments. Conversely, if your stocks rise by 30%, your portfolio will only gain 15%.

This table shows how a market downturn affects your portfolio based on the percentage of risky assets you hold:

What Determines Your Risk Tolerance

Age, responsibilities, and need for security: Risk tolerance is highly individual.

- Generally, younger people can afford to take more risks because they have many years of earning potential ahead. They also have more time to ride out crises and buy shares at lower prices during downturns.

💡 Rule of Thumb

100 – Your Age = Risk Allocation in %

This simple formula helps you calculate your risk tolerance:

- At 20 years old, you could allocate 80% to risky investments.

- At 60 years old, you might allocate 40% to risky investments.

While age is important, other factors also influence your risk tolerance:

- A high salary allows you to take on more risk.

- Financial education increases your confidence and security.

- Your ongoing financial obligations also play a role.

Questions to Determine Your Risk Tolerance

- How old are you?

- Do you earn a high income?

- Do you already have significant wealth?

- Are you financially knowledgeable?

- Do you have loans or mortgages to pay off?

- Are you financially responsible for others?

These are just some of the relevant factors. Individual circumstances, such as health, may also play a role.

Consider how much risk you can and are willing to take. Decide how much to allocate to risky investments and how much to low-risk assets, then choose suitable products for each category.

Risk Tolerance Can Change Over Time

- Your life situation may change (e.g., starting a family, having children, or changes in income).

- You gain experience over time. The first market downturn is a new experience for every investor, but you’ll learn that fluctuations are normal.