Costs and Fees with ETFs

💡Take Away

- When selecting ETFs, the Total Expense Ratio (TER) is an important decision-making criterion. You can find it in the factsheet.

- The TER summarizes all management costs charged by your ETF provider. The provider deducts these costs annually from the fund volume.

- It’s best to trade during the official exchange hours of the reference exchanges, otherwise, you may pay more for securities due to a higher spread.

- Transaction costs arise when buying and selling. They consist of custody fees and exchange fees.

Overview of the main costs:

| Cost Type | Description | Cost Center |

|---|---|---|

| Transaction Costs | Purchase and sale fees / Custody fees | Custodian Bank |

| Total Expense Ratio (TER) | Includes management fees, marketing budget, index licensing fees | ETF Provider |

| Spread & Exchange Fees | Difference between buy and sell price | Exchange |

Transaction Costs and Custody Fees

Depending on the broker you use to buy and store your ETFs, additional transaction costs and custody fees may apply.

- For each transaction, i.e., when buying or selling securities, brokers may charge an order fee. This fee is set by the broker themselves.

- Some newer providers, such as Neo-brokers and Smart brokers, often offer very low fees, free savings plans, and free custody accounts.

Therefore, it is important to compare different brokers before making a decision!

Total Expense Ratio (TER)

The Total Expense Ratio (TER) is the overall cost ratio. The ongoing costs of an ETF include

- licensing fees

- marketing fees

- administrative costs

For example, the iShares Core MSCI World ETF has a TER of 0.2%. If you invest €10,000 in this ETF, your annual total cost would be €20.

The ETF provider deducts the fees from the fund itself. Therefore, the TER is not deducted directly from your account; instead, the fund volume decreases. In other words, you pay with a slightly lower fund performance.

Since 2004, ETF providers are legally required to disclose the TER. You can find it in the fund prospectus, on the provider’s website, or in the ETF’s factsheet—anywhere the ETF is listed.

The Spread Between Bid and Ask

In stock trading, there are always two prices: the buy price and the sell price.

- The demand side wants to buy the stock and offers a certain amount of money, known as the bid price.

- The stock owners make an offer. The lowest price on the offer side is called the ask price.

The difference between these two prices is the spread, also known as the bid-ask spread. For the buyer, it is beneficial if both prices are as close to each other as possible.

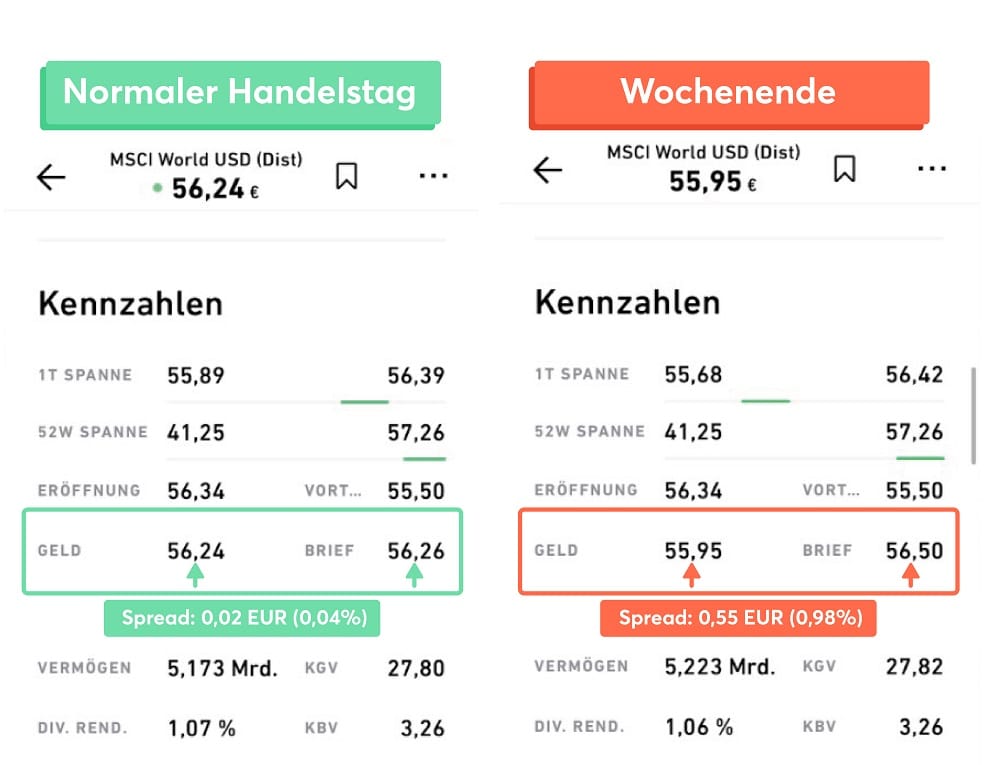

Outside of the regular trading hours of major exchanges like Xetra, less trading occurs. Some marketplaces take advantage of this by offering longer trading hours. During this time, the spread is usually wider. The spread when trading outside of regular market hours can make a significant difference!

When trading outside regular hours, the spread often increases because there is less liquidity, meaning fewer buyers and sellers. As a result, the difference between the bid and ask price widens, which can increase the cost of executing a trade.

Example: Left: normal trading day; Right: weekend

The Right Time to Trade

Traditional financial institutions typically trade on major national exchanges, such as those in Frankfurt or Stuttgart.

- Xetra, the trading platform of Deutsche Börse AG, is the leading venue for trading stocks and ETFs. Here, a large volume of stocks change hands daily, and due to the high trading volume, the spreads are relatively low.

Recently, so-called neo-brokers have started to disrupt the market. These neo-brokers include platforms like Trade Republic, Scalable Capital, and Smartbroker.

- For example, Trade Republic executes its trades through the electronic trading system of the Hamburg Stock Exchange, LS Exchange. Through this, you can trade from 7:30 AM to 11:00 PM.

- However, the reference exchange, Xetra, is only open from 9:00 AM to 5:30 PM. During Xetra’s hours of operation, the spreads on LS Exchange are aligned with those on Xetra. When Xetra is closed, the spreads on LS Exchange may widen, meaning you will pay more than necessary!

Savings Plans Avoid Unnecessary Costs

ETF savings plans are unaffected by the off-exchange spread risk. They are always executed during the official trading hours of the reference exchanges.

Are ETFs Cheaper Than Individual Stocks?

Depending on whether you’re following a stock or ETF strategy, different costs apply.

| Individual Stocks | ETFs |

|---|---|

| Transaction Costs | Relatively high |

| Management Costs (TER) | None |

| Spread & Exchange Fees | Depends on the exchange |

- If you buy many stocks yourself, you’ll incur higher transaction fees. However, with an ETF savings plan, these fees can be completely avoided.

- Individual stocks don’t have ongoing management costs like the TER (Total Expense Ratio) of ETFs.

If you want to diversify globally, ETFs are the way to go: buying thousands of individual stocks would be expensive and time-consuming.