Saving Plan

💡Take Away

The advantages of an ETF savings plan include reduced effort through the automation of saving and investing. Psychologically, an ETF savings plan also helps by lowering the barrier of having to motivate yourself to invest money each time. This allows you to build wealth in the background.

New offerings make it easy to set up and execute an ETF savings plan.

Settings such as the savings interval or dynamic adjustment of the savings rate allow for individual solutions that can be easily customized.

Steps to set up an ETF savings plan:

- define your savings rate,

- choose an ETF,

- determine the savings interval and duration,

- specify a reference account/set up a standing order.

The order of steps may vary depending on the broker.

Who is an ETF Savings Plan Suitable For?

The ETF savings plan is ideal for investors or savers whose goal is to build wealth over the long term.

The ETF savings plan also offers flexibility. You can sell your ETF holdings at any time or cancel the savings plan entirely, providing quick liquidity if needed.

How an ETF Savings Plan Works

With an ETF savings plan, shares of a specific ETF that you have chosen are purchased monthly (or at another frequency). The amount and frequency of the savings contribution are up to you.

How to Set a Saving Plan

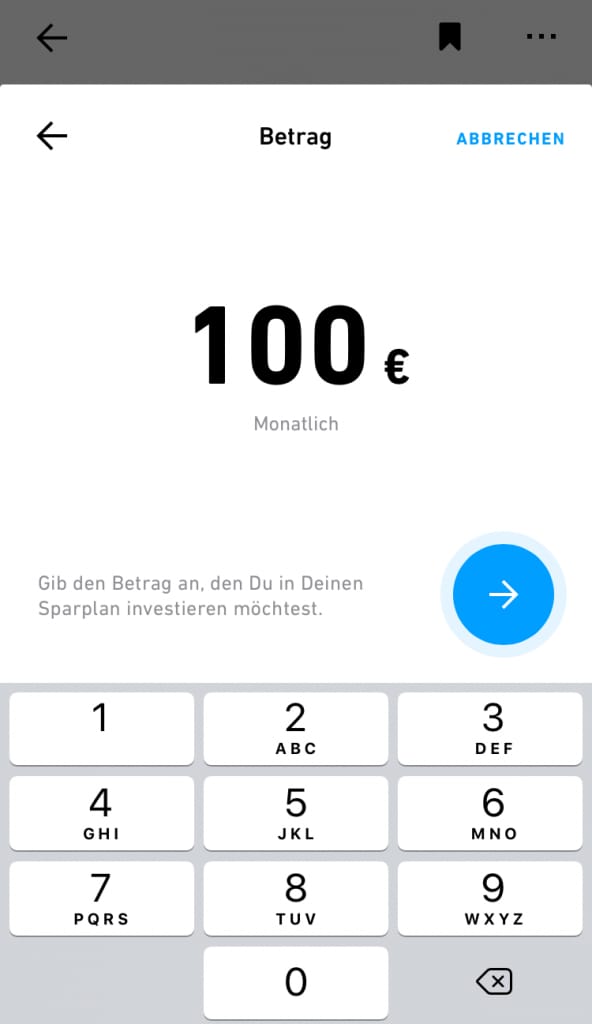

Set Your Savings Rate

In the “Invest” section of your online broker’s platform, enter your desired savings rate—regardless of how frequently you plan to invest.

- The higher your savings rate, the more your wealth can grow in the long term through the power of compound interest.

- f you mainly want to invest passively via an ETF savings plan, you should carefully consider how much money you can spare to invest.

- With the most affordable brokers, the minimum savings rate per ETF is usually €25—or even just €10.

Example

Find the ETF of Your Choice

Using your broker’s search tool or the product search on ETF providers’ websites

- You can compare ETFs from different providers based on criteria like performance or cost.

- You’ll also find the WKN or ISIN – the identification number of your ETF.

Don’t let the wide range of ETFs offered by various brokers overwhelm you!

- Before setting up your ETF savings plan, you should have chosen a strategy that fits your risk profile.

- With the WKN or ISIN, you can easily locate your ETF and add it to your savings plan. Each ETF also comes with a factsheet containing key information.

It’s important to note that not every ETF is eligible for a savings plan with every broker. If you plan to invest in a specific ETF through a savings plan, make sure in advance that your preferred broker actually offers this ETF in their savings plan program.

Determine the Interval and Duration of Your Savings Plan

Decide how often you want your specified savings rate to be invested from your account into the ETF – and how long the plan should run.

The classic interval is a monthly savings plan.

After receiving your salary, a portion is automatically deducted via standing order for the ETF savings plan.

Other intervals can also be practical, depending on your strategy.

If the minimum savings rate required by your preferred broker is higher than your desired savings rate, you can increase the savings interval—that is, extend the time between contributions.

Example

The fee structure should also factor into your decision about the interval.

- If there’s a fixed fee per savings plan execution, it makes more sense to have a larger savings rate—so in that case, increasing the interval is wise.

- For percentage-based fees or free plan executions, it doesn’t make a difference whether you invest higher amounts less frequently or smaller amounts more often.

If you want, you can also limit the duration (validity period) of your savings plan. However, this isn’t necessary since ETF savings plans aren’t set in stone—you can change or cancel them at any time if your needs or preferences shift.

Dynamic Increase of the Savings Rate

With the dynamic increase feature, you can set your savings rate to automatically rise each year.

- It allows you to adjust your savings rate in line with inflation, rising income, or growing financial goals. This is a useful function offered by some brokers, such as Scalable Capital, Consorsbank, or Flatex.

- Even if your broker doesn’t offer this feature, you can still “dynamize” your savings rate manually by regularly adjusting it yourself.

Specify Reference Account and Set Up Standing Order

Indicate which account the savings amounts should be debited from. Now all you have to do is submit the savings plan and activate it using a TAN (Transaction Authentication Number).

- Many brokers offer a convenient direct debit option, which means you don’t have to do anything else—just make sure your external reference account has enough funds when the deductions are made.

- If your broker does not offer this feature, the easiest alternative is to set up a standing order to the reference account. This helps you stay disciplined with your investing habits.

At the very end, simply review and confirm the details of your ETF savings plan.