70/30 Portfolio - The Classic Global Portfolio

💡Take Away

- The 70/30 portfolio is a simple way to build a globally diversified investment portfolio.

- It invests broadly in stocks, with 70% allocated to developed markets and 30% to emerging markets.

- Developed markets are passively tracked using ETFs like the MSCI World, while emerging markets are typically represented by an MSCI Emerging Markets ETF.

👉 How to Proceed

- Use ETF search tool to find suitable ETFs that cover developed and emerging markets. Apply filters for costs and fund size.

- Preferably choose the same index provider for both developed and emerging markets.

- Invest in ETFs with a fund volume of at least €100 million and a minimum track record of 3 years.

What is the 70/30 Portfolio?

The 70/30 portfolio is a type of globally diversified investment portfolio.

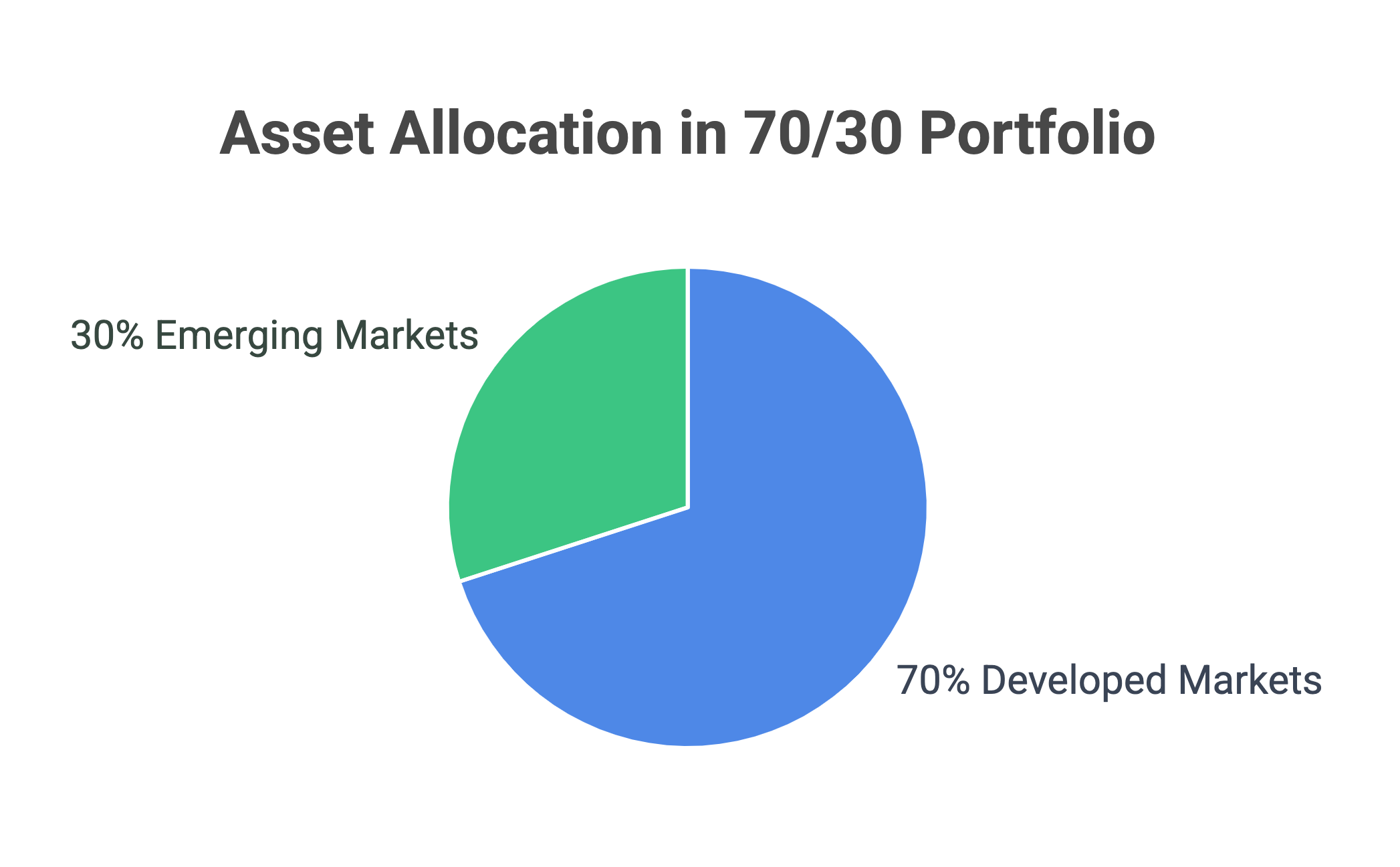

- It invests broadly in stocks—70% in developed markets and 30% in emerging markets—following a passive investment approach. This means that instead of selecting individual stocks, investors track the overall market, making it a simple investment strategy.

- Since the 70/30 portfolio consists entirely of stocks, it represents the riskier part of a broader investment strategy. Depending on your risk profile, adding a lower-risk component might be beneficial. However, the 70/30 ratio within the stock portion remains unchanged.

What Does the 70/30 Portfolio Consist of?

The 70/30 portfolio is built using just two indices:

- 70% for developed markets (e.g., MSCI World).

- 30% for emerging markets (e.g., MSCI Emerging Markets).

These two indices together provide broad global diversification.

Developed Markets (70%)

The most commonly used index for developed markets is the MSCI World. There are many ETFs tracking this index, often with large fund volumes. The largest global ETF is also based on the MSCI World.

An alternative to the MSCI World is the FTSE Developed index. However, the selection of ETFs tracking this index is significantly smaller.

Another option is the Solactive GBS Developed Markets Large & Mid Cap index. However, the availability of ETFs tracking this index is also limited.

Emerging markets (30%)

Emerging markets are typically represented by the MSCI Emerging Markets index. This index is widely used by fund providers when they want to track the stock markets of emerging economies.

‼️Attention

The classification of countries into developed and emerging markets varies between index providers. For example, South Korea is classified as an emerging market by MSCI, but as a developed market by FTSE. Therefore, it is advisable to use the same index provider for both developed and emerging market allocations in your portfolio to maintain consistency.

Advantages

Advantages of the 70/30 Portfolio:

Globally diversified

The 70/30 portfolio offers broad global diversification by investing in both developed and emerging markets.

Low complexity

The portfolio consists of only two ETFs, making it easy to manage and implement without complexity.

Can be implemented with many ETFs

There is a large range of ETFs that can be used to implement this portfolio

Low costs

Political risk premium for emerging markets

Investment in emerging markets is expected to offer higher returns due to increased political risk, such as lower legal security in emerging countries. The political risk premium has historically compensated for the risk taken.

Good risk-return ratio

Disadvantages & Criticism

While the 70/30 portfolio has many advantages, it also has disadvantages.

- Annual rebalancing needed

- One-ETF version is even simpler

- Higher political risk in emerging markets

Examples

It’s best to use 2 ETFs from the same index provider, as the country classification may differ. When assembling the portfolio, you can filter the ETFs in ETF search by criteria such as costs or fund volume.

Especially Cost-Effective 70/30 Portfolios

When investing, it’s important to keep costs as low as possible. Therefore, ETFs with a low TER (Total Expense Ratio) are recommended.

Developed market ETFs

Emerging Markets ETFs

70/30 Portfolios with Particularly Large Funds

The larger a fund is, the less likely it is to be closed. Often, large ETFs are relatively inexpensive because the fund company can manage a large ETF at a lower cost.

Developed market ETFs

Emerging Markets ETFs